The Power of Compounding: Small Steps, Big Results

Introduction

Have you ever heard the saying, “Little drops of water make the mighty ocean”? That’s what compounding is all about. It’s the simple idea that small amounts, when allowed to grow over time, can turn into something surprisingly big.

What is Compounding?

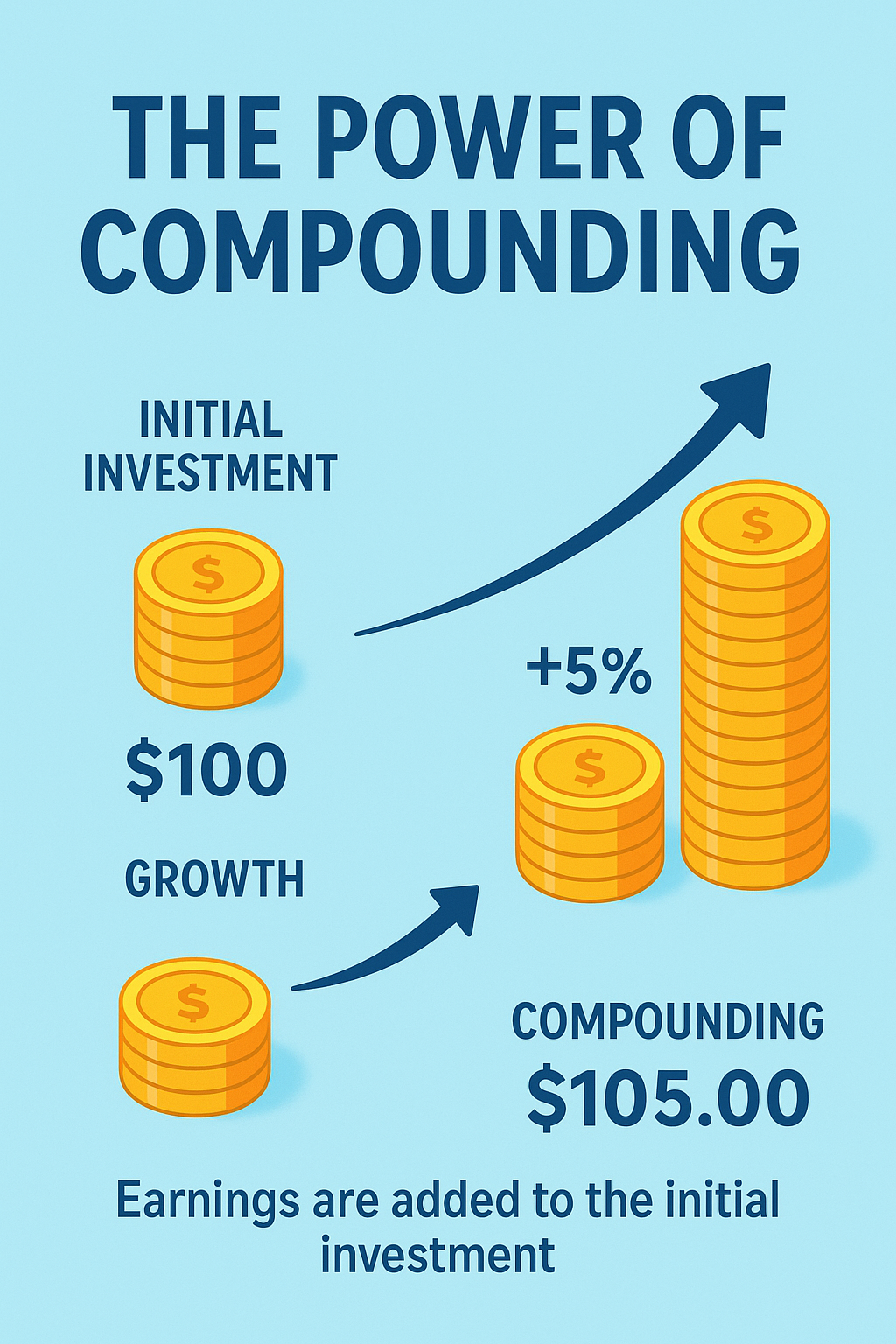

Compounding means earning returns not just on the money you put in but also on the returns that money has already earned. In other words, your money starts working for you, and then the money it earns also starts working.

Think of it like planting a tree:

• In the first year, you plant a seed.

• The next year, the seed grows into a small plant.

• Soon, the plant grows branches, and those branches grow leaves.

• Over time, the tree becomes bigger and stronger, giving more shade and fruit.

That’s how compounding works with money too.

Example

Imagine you save ₹1,000 and earn 10% interest every year.

• After 1 year, you have ₹1,100.

• In the 2nd year, you don’t just earn interest on ₹1,000 but on ₹1,100. So you get ₹110, making it ₹1,210.

• In the 3rd year, you earn interest on ₹1,210, and it keeps going.

Over time, the growth becomes faster and bigger, even though you didn’t add any extra money.

Why is Compounding Powerful?

1. Time is your best friend. The earlier you start, the more time compounding has to work its magic.

2. Small amounts matter. Even small savings can grow into something meaningful if given enough time.

3. Patience pays off. Compounding rewards those who wait. The longer you leave your money invested, the bigger the results.

A Short Story: Riya and Arjun

Riya and Arjun are two friends who both want to save money.

• Riya starts saving ₹500 every month from the time she is 20 years old. She keeps doing this until she turns 30, and then she stops. In total, she has saved for 10 years.

• Arjun doesn’t start early. He began saving the same ₹500 every month, but only from the age of 30. He continues saving until he is 60, which means he saves for 30 years.

Now here’s the surprise:

Even though Arjun saved for a much longer time, Riya often ends up with more money by the age of 60, just because she started earlier. That’s the magic of compounding. Her money had more years to grow, and the growth built on itself year after year.

Everyday Example

Think about a piggy bank. If you put in a coin every day, it looks small at first. But after a year, it’s heavy and full. Now imagine if that piggy bank also gave you extra coins for keeping money inside it—that’s compounding!

Summary

Compounding is not just a financial concept; it’s a life lesson. Whether it’s saving money, learning a skill, or building good habits, small consistent efforts grow into something powerful over time. “Compounding is the reward for patience. Start small, start early, and let time do the magic.”